More developed, the credit market shows resilience when facing turbulence and waiting for new opportunities

The Brazilian debt market has encountered high volatility in 2023, largely driven by the shockwaves of corporate events such as the Americanas and Light cases, as well as the burden of elevated interest rates on companies’ debt service. However, the sector has shown maturity in face of these challenges and is preparing for new opportunities — an evolution that reflects a decade of development.

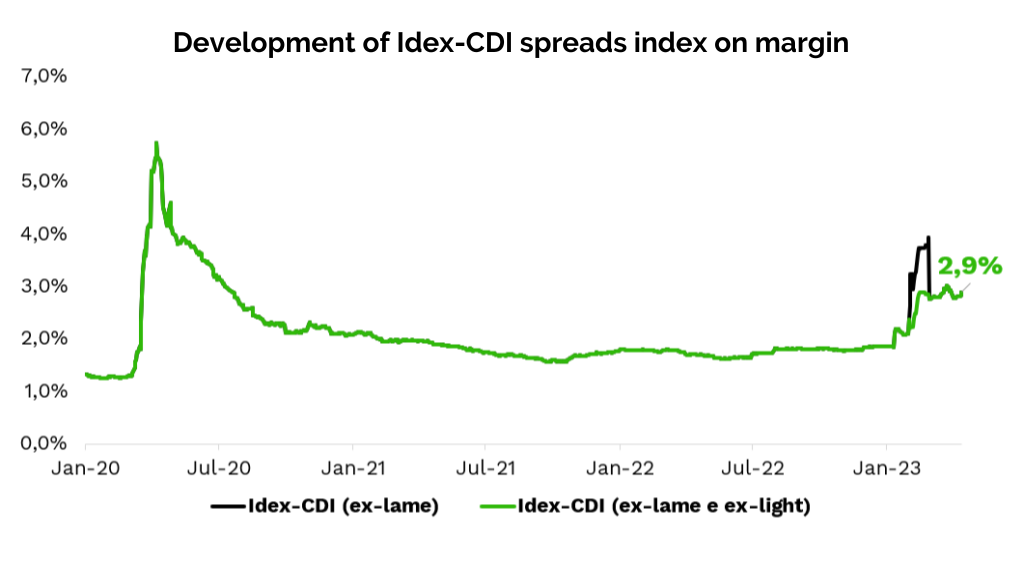

In recent months, the credit market has experienced a notable increase in spreads and withdrawals, which began in January after the court-supervised recovery of Americanas and further escalated in February with the announcement of a debt restructuring operation by the energy group Light. Nevertheless, according to the Idex-CDI benchmark index published by asset manager JGP, the market turbulence has been comparatively more contained than, for example, during the Covid-19 pandemic.

According to Alexandre Theoharidis, Portfolio Manager for Credit Strategy at Compass Group Brasil, the pandemic struck during a period when the industry was still under development, and the liquidity in the secondary market was relatively low. As a result, spreads surged from a 1.3% premium over the market benchmark CDI to a substantial 5% premium or even higher.

However, the imbalances caused by the pandemic also yielded a positive outcome, ultimately contributing to the industry’s current level of maturity. As Guilherme D’Aurea, Private Credit Manager at Asset Management, highlights, during that period, top-tier companies offered significant premiums to creditors. This environment attracted several new participants to the industry, ranging from asset management firms and institutional investors to retail investors.

“The increase in the number of players resulted in improved market liquidity, a crucial factor for this industry,” he explains. Prior to this juncture, one of the primary challenges in the sector was the scarcity of buyers, making it difficult for bondholders to sell their assets.

“Thanks to the influx of new players and a brighter economic outlook in the post-pandemic period, the industry enjoyed a golden era in 2021 and 2022,” highlights Mr. D’Aurea. “During this time, companies issued over BRL 200 billion in fixed income assets annually, and the funds reported remarkable returns.”

The period also witnessed a surge in investor demand, propelled by a process of monetary tightening. Consequently, spreads narrowed. “By mid-2022, spreads had already stabilized at levels closer to the fair value of assets. Prices became fairer, and there was little premium remaining,” observes Mr. Theoharidis.

Then, in early 2023, the Americanas’ crisis struck. “It was a new shock, but Anbima’s market-to-market system was very efficient, preventing technical issues,” explains Ana Rodela, Head of Debt Trading at Bradesco Asset. “That’s why withdrawals were less intense than in previous crisis, which avoided issues such as the first investors to claim a redemption would receive higher quotas”.

Perspectives

According to Alexandre Müller, Credit Manager at JGP, events such as the court-supervised reorganization of a major conglomerate like Americanas have a detrimental effect on investors’ trust and their expectations of companies. Consequently, the impact of elevated benchmark interest rates becomes more pronounced, posing greater challenges for smaller and more vulnerable companies.

“The credit cycle has deteriorated since January, with spreads measured by the Idex CDI index increasing by 100 basis points over the year”, he explains. The encouraging news, however, is that spreads have reached a point of stability in the past 40 days. “We are beginning to believe that spreads will no longer rise but rather stabilize moving forward.”

His optimistic outlook is reinforced by projections of a potential 3% decline in Brazil’s yield curve, which would alleviate the burden on companies’ debt service. Furthermore, the announcement of new issuances that improve debt/net worth ratios and credit prospects brings potential positive outcomes. “These events could provide some assistance”, Mr. Müller states. In the meantime, the manager is favoring top-tier bonds in his investment strategy. He also identifies promising opportunities for companies undergoing special situations that require support in their restructuring efforts.

Guilherme Benites, Partner and Director at Aditus, is carefully monitoring the potential narrowing of spreads. Meanwhile, he advises his clients that now is an opportune time to consider reentering the bond market. “With premiums hovering around CDI + 2% or 2.2% and the secondary market under pressure, the ideal moment for a comeback is not too far off, likely in the second half of the year.”

However, investors and fund managers need to exercise caution and approach opportunities with care, particularly in sectors with wider spreads such as healthcare and retail. “This is a potentially favorable moment to invest in funds that employ a fundamental analysis approach when selecting assets, given the delicate nature of the current period,” advises Mr. D’Aurea from Santander Asset Management.

In his view, infrastructure-related bonds (debêntures) present an attractive option at the moment, with premiums currently standing at historically high levels of 2% to 3%. Furthermore, these companies operate within defensive industries such as energy and water utilities, providing higher premiums and tax exemptions.

Mr. Theoharidis from Compass Group agrees that investing in infrastructure-related bonds is a wise decision, driven not only by favorable spreads but also by elevated real interest rates. Additionally, the NTN-B bonds curve is currently at historically high levels, providing an enticing investment environment, particularly for those seeking protection against inflation. He further highlights the agribusiness sector as offering promising opportunities at this time