Study Shows Audit Committees Gain Importance In Listed Companies, While Fiscal Council’s Shrink

According to a survey carried out by ACI Institute Brazil (KPMG’s corporate governance branch), audit committees are becoming more popular among the main companies listed on the stock exchange B3, while the number of fiscal councils is shrinking.

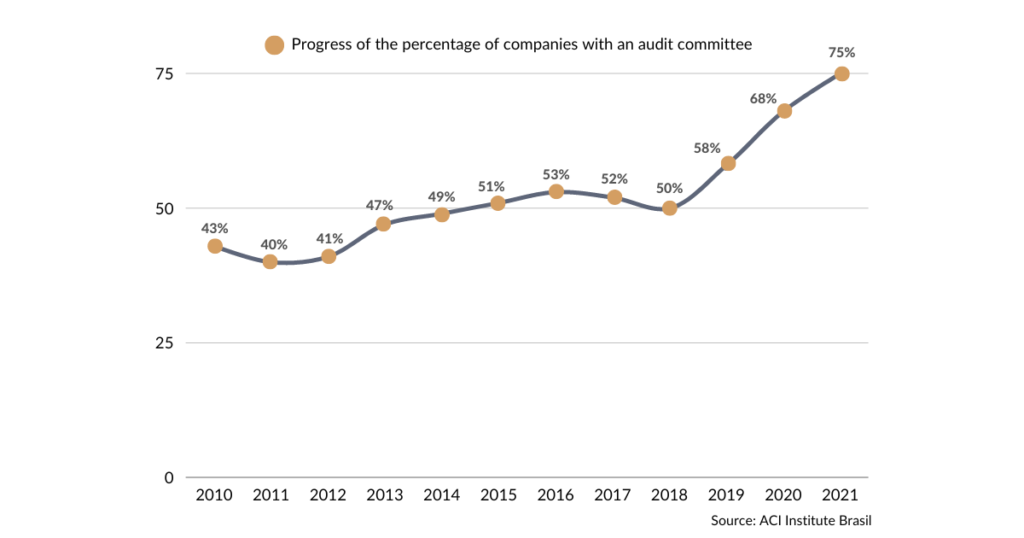

The latest edition of the study, which compiles data from 280 companies up to May 2021, finds that 75% of companies have an audit committee, compared to 68% in the previous year. It represents a 25% growth when compared to 2018 data. Read the full survey here.

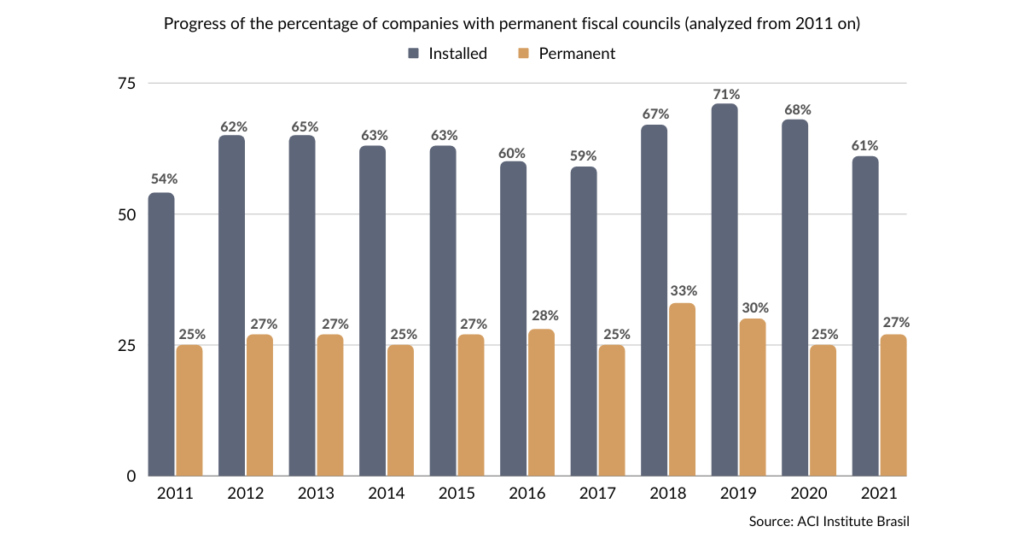

On the other hand, fiscal councils go in the opposite direction: after rising from 59% in 2017 to 71% in 2019, this figure fell to 61% in 2021. The same applies to the prevalence of permanent fiscal councils, which peaked at 33% in 2018 and dropped back to 27% in 2021.

Although the role of audit committees gained ground after the IPO boom of 2006 to 2008 — meeting the demands of foreign and institutional investors — it was B3’s requirement for companies listed on the Novo Mercado to feature audit committees that has boosted their relevance since 2018.

On the other hand, despite losing their relevance, fiscal councils have been present in Brazilian legislation since 1940. However, there are records of their existence since the first half of the 19th century.

Many controlling shareholders are against the simultaneous operation of the two bodies, often under the argument that, in the USA, the Sarbanes-Oxley Act, known as SOX, would not allow the listing of foreign companies that only have a fiscal council — which is not true.

Sidney Ito, ACI Institute’s CEO, believes both bodies have meaningful roles in maintaining a high level of corporate governance. “I don’t believe that their functions overlap. The responsibilities are different because they do not have the same competencies and do not perform the same activities,” he notes.

Mr. Ito also highlights that the fiscal council is a powerful tool to assist minority shareholders in overseeing the management’s acts, which is even more critical in markets with a concentrated capital structure, such as Brazil.

“The fiscal council has a key role for those companies with a defined controlling shareholder, whether the state owns it, a family, a multinational company or there is a sharing of control. This is the predominant model in Brazil, which is in line with the European or Asian models”, Ito comments. It is worth remembering that, according to the current B3 rule, these committees must have at least three members, with at least one independent director.

Out of the 280 companies analyzed by ACI’s survey, 18% declared that they maintain an audit committee and a fiscal committee, less than the 20% of the previous issue. Per sector, the lowest occurrence was in the Novo Mercado, where 14% of the companies maintain both bodies, while Level 1 has recorded the highest level, at 42%.